COVID-19 Resources And Strategic Advising

Visit the new Federal Resources from America’s SBDC and the SBA for guidance on all things COVID-19 Recovery, then contact your local Wyoming SBDC Network advisor for assistance on implementing these resources.

Assistance Is Available – Register Below To Become A Client Today!

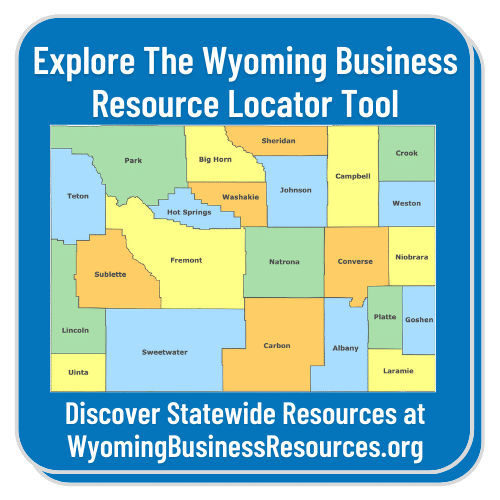

The Wyoming SBDC Network staff is located throughout the state and is capable and able to meet with you virtually (phone, web conferencing) to assist you. We offer confidential, no-cost technical assistance to help create a strategy specific to your business needs.

The Wyoming SBDC Network staff is located throughout the state and is capable and able to meet with you virtually (phone, web conferencing) to assist you. We offer confidential, no-cost technical assistance to help create a strategy specific to your business needs.

We have recently expanded our current advising opportunities with the The Wyoming SBDC Network CARES Act Recovery Program. This program will provide FREE support and assistance throughout all four phases of business recovery during the COVID-19 pandemic: Response, Recovery, Resiliency, and Reinvention. Armed with first-hand small business experience, our expanded team of advisors are pulled from all areas of interest and come from a wide variety of industry backgrounds.

Contact your local Wyoming SBDC Network advisor to make an appointment by entering your email address and county in the form above.

Get in touch with your local advisor today and learn how to receive no-cost, confidential assistance and learn more about COVID-19 resources for small businesses.

RESOURCES BY TOPIC

The Wyoming SBDC Network, as part of our emergency preparedness strategies for businesses, is ready to strategize with entrepreneurs statewide to develop individualized plans to keep your business running as smoothly as possible throughout the COVID-19 pandemic.

Virtual training has been offered in numerous business concentrations through the CARES Act Recovery Program throughout the pandemic. You can find links to all of these webinars below at absolutely no cost to you or your business. As always, you can reach out to you regional advisor for more assistance with any of these topics or further training opportunities.

Information and COVID-19 resources for small businesses are changing frequently, so check back regularly for the latest updates.

Webinar Recordings

Accounting & Finance

- So That’s Where The Money Goes

- Stop Giving Away Your Profit

- Profit Mastery, COVID-19 Response

- Business Debt Restructuring: A COVID-19 Survival Strategy

- Keys To Getting Your Money On Time: Construction Liens, Bonds, and Notices

- Your Business Is Not Making Money, This Is What You Are Missing

- Things Your Accountant Hasn’t Told You About Your Business

Business Best Practices

- Business Transition Planning

- Best Practices For Pop-Up Shops

- Exit Strategies and Preparing Your Business For Sale

- Business Growth Planning Session 3

- Business Growth Planning Session 2

- Business Growth Planning Session 1

- Best Practices For Working With A Web Developer

- Get Your Side Hustle On: Build Your Dream Job While Keeping Your Day Job

- Small Business Self-Sabotage

- Disrupting or Prompting? Has The Pandemic Affected Your Approach To Business

- Aligning Your Business With Your Personal Values

- How to Be An Exceptional Salesperson

- How Businesses Thrived in 2020: Practical Tools and Resources You Can Implement Today

- The Power (and the Pitfalls) Of Email

- Avoiding the OTHER Pandemic: Small Business Self-Destruction

Business Values & Community Building

- Crowdfunding For Small Business

- Tools of Engagement For Virtual Meetings

- Harnessing The Power Of Virtual Events For Your Brand

- Keys To Mastering Virtual Meetings

- Aligning Your Business With Your Personal Values

- Tactics To Protect Yourself During Challenging Times

- Helping Others Through Challenging Times

Cybersecurity & SEO (Search Engine Optimization)

E-Commerce

- Best Practices For Using E-Newsletters In Your E-Commerce Strategy

- E-Commerce Stores: From Set-up to Delivery Part 1

- E-Commerce Stores: From Set-up To Delivery Part 2

- Optimizing Content For Online Stores

- Make Black Friday, Small Business Saturday or Cyber Monday Work For Your Business

- Shipping Fulfillment Practices for the Holidays And Beyond

- How to Write Product Descriptions For Your E-Commerce Store

- Smartphone Photography for E-Commerce: Intro to Photography and Best Practices

- Smartphone Photography for E-Commerce: Creating a DIY Photo Studio

- Smartphone Photography for E-Commerce: Editing and File Organization

- Writing Service Descriptions For Your Website

- Harnessing The Power Of Virtual Events For Your Brand

- What’s New In Customer Reward Programs

- Capturing Repeat Customers In-Store and Online

E-Learning

- Tools of Engagement for Virtual Meetings

- Keys to Mastering Virtual Meetings

- DIY Course Creation for Businesses

- Using eLearning To Support Your Business

- Creating Energized Web Content: Telling Customers Your Story

- Creating Courses For How Adults Learn

- Show Don’t Tell: Harnessing the Power of Storytelling in eLearning

- Harnessing The Power Of Virtual Events For Your Brand

- Harnessing The Power Of Storytelling In Adult Learning

HR & Team Management

- Onboarding: Building and Growing Your Team

- Technical Aspects of a Post-COVID-19 Workplace

- Avoiding the OTHER Pandemic: Small Business Self-Destruction

- Culture and Communication in the COVID-19 Workplace

- Human Resources For the COVID-19 Era

- The Power (and the Pitfalls) Of Email

- Tactics To Protect Yourself During Challenging Times

- Helping Others Through Challenging Times

- Team Up For Success!

- When Your Management Style Isn’t Working Your Employees Aren’t Either

- Tools of Engagement For Virtual Meetings

Inventory Management

Marketing Strategy

- How Understanding Your Customer Can Help Your Business Grow

- Marketing Is Everything…And Everything You Do Is Marketing

- Best Practices For Using Newsletters In Your E-Commerce Strategy

- Pinpointing Your Brand and Target Market

- Harnessing The Power Of Virtual Events For Your Brand

- Strategically Plan Your Holiday Season Marketing

- 360-Degree Marketing for Your Business

- Email and Digital Advertising For Your Small Business

- Plan Your Content Marketing Strategy For the Holiday Season

- Make Black Friday, Small Business Saturday or Cyber Monday Work For Your Business

Tourism

- Endless Summer: How your Wyoming Tourism Season Can Be Year-Round Despite COVID-19

- Squirrel Not Bear; That’s WY! – Make Wyoming Tourism Last Year Round

- COVID-19 Recovery For The Hospitality Industry

Email sbdccares@uwyo.edu for a copy of the workbooks

Town Halls

- COVID-19 Tax Credits for Small Business – 6/11/2020

- WBC Business Interruption Stipend (in lieu of Virtual Town Hall) – 6/4/2020

- Wyoming’s Small Business Strategy – 5/21/2020

- EIDL/PPP Updates – 5/14/2020

- Unemployment Benefits – 5/7/2020

- WBC Wyoming Transition Webinars (in lieu of Virtual Town Hall) – 4/30/2020

- Staying in Touch with Your Customers – 4/24/2020

- SBA Relief Efforts – 4/16/2020

- Town Hall: Updated Guidance For PPP 2021 and Other COVID-19 Relief – 1/21/21

Virtual Summit: Finding Your Competitive Advantage In A Post COVID-19 Economy

Loans and Capital – Currently Closed For Applications

Wyoming Business Relief Programs - Closed

***UPDATE***

12/22/20

All fund have been expended and will be dispersed.

12/11/20

Visit wyobizrelief.org for more information and to apply.

Hospitality Relief Program is now open to applications for businesses that have been affected by the early closure rules in the lates statewide health orders. Applicants can apply for up to $50,000

Pandemic relief for Wyoming hospitality businesses whose operations were interrupted by the reduced hours provisions in recent health orders.

-

Timing: Opens December 10, 2020; Closes December 16, 2020, at 5 p.m.

-

Funding: Up to $50,000; Cannot apply more than one time

-

Eligible Entities: Any bar, tavern, restaurant, or hotel deriving its primary revenues between the hours of 10:00 p.m. and 5:00 a.m. from the on-premises sale and consumption of malt beverages, wine, and/or liquor

-

Eligible time frame: December 9 to 30, 2020

APPLICANT ELIGIBILITY

-

Established on or before December 1, 2020

-

Independently owned and operated

-

As of December 1, 2020, had at least one full-time employee or more

-

Headquartered in Wyoming as of December 9, 2020, and be a licensee in good standing of the Wyoming Department of Revenue Liquor Division

-

Brew Pubs, Breweries, Distilleries, and/or Vineyards are eligible to apply subject to the criteria above but may apply only for losses associated with on-premise sales and consumption of malt beverage, wine, and/or liquor in their own bars or tasting rooms, whether on- or off-site

-

Non-profits of any type are eligible to apply under this program, subject to the other eligibility criteria

-

10/29/20

In May 2020, the Wyoming Legislature created three programs to distribute $325 million in federal CARES Act funding to Wyoming businesses and nonprofits that have experienced hardship related to the COVID-19 crisis. The Wyoming Business Council is distributing these dollars through the COVID-19 Business Relief Program, which consists of five funds: the Interruption, Relief, and Mitigation Funds, which are now all closed; and the new Agriculture and Endurance Funds, which are open November 2 to 18, 2020.

Agriculture Fund:

For Wyoming ranchers and farmers who have lost revenue due to public health orders or incurred COVID-19 related expenses

$90 million available

Up to $250,000 per applicant

Opens Nov. 2, 2020, 10 AM

Closes Nov. 18, 2020, 8 PM

Endurance Fund:

Ongoing pandemic response for COVID-19 related losses and expenses for Wyoming businesses and some nonprofits

At least $24 million available

Up to $250,000 per applicant

Opens Nov. 2, 2020, 10 AM

Closes Nov. 18, 2020, 8 PM

Visit wyobizrelief.org to apply and find out more.

8/6/20

To accommodate high demand for funding by businesses and nonprofits, Governor Mark Gordon quickly secured full funding for the current wave of the COVID-19 Business Relief Program.

More than 1,600 small businesses and nonprofits submitted applications by 5 p.m. Wednesday, Aug. 5, totaling nearly $150 million in requests for the Relief and Mitigation funds. The Wyoming Business Council initially set aside half the funding to accommodate potential future requests by seasonal businesses involved in agriculture, retail and tourism that may accrue losses later this year. The recent high demand caused the Business Council to release all the funding.

“The release of the full allocation of funds will help meet the demonstrated needs of those businesses and nonprofits that have been impacted by the COVID-19 pandemic already, ” Governor Gordon said. “I want to ensure that Wyoming’s businesses and its economy stay healthy and Wyomingites are able to keep working.”

“We encourage all eligible entities to apply now as we are unsure how long the money will last,” Business Council CEO Josh Dorrell said.

Go to wyobizrelief.org to stay informed about program details and to register to receive Business Council news releases.

8/4/20

WBC Relief and Mitigation grant applications are now open!

7/29/2020

A second round of relief funding is being discussed and applications will be accepted sometime during the first week of August.

-

Timing: First week of August

-

Funding: Up to $300,000; Cannot apply more than one time per program

-

Eligible Entities: Businesses with 100 or fewer employees and 501 (c)3, (c)6, (c)12, (c)19 nonprofits with at least one paid full-time employee and no more than 50 percent of time spent on lobbying

-

Eligible time frame: March 13, 2020 to application date

-

Total Funding Available: $175 million

-

$50 million is set aside for businesses that were required to close by public health order and either received dollars from the Interruption Fund and have additional losses due to COVID-19 or were unable to apply in the first round.

-

$125 million is available to eligible businesses and nonprofits for incurred COVID-19-related expenses and direct or indirect revenue losses due to public health orders

-

7/2/2020

The application process has now closed for the Business Interruption Stipend grant as of 7/2/2020

6/12/2020

As of midday Friday (6/12), the Wyoming Business Council (WBC) had received more than $60 million in Business Relief Stipend program applications and had approved $2.95 million of applications for payment.

The WBC is still accepting applications for the Business Interruption Stipend. Program eligibility, more information and the application link are available at wyobizrelief.org.

6/11/2020

The Wyoming Business Council (WBC) encourages business owners who did not receive Payment Protection Program funding and were directly affected by state public health orders to apply by 1 p.m. on 6/11/2020 to retain priority status for the Business Interruption Stipend program.

Business Council staff is currently reviewing applications from business owners who did not receive federal assistance AND whose types of businesses were named in state orders enacted to fight the spread of the novel coronavirus.

Beginning 1 p.m. Thursday, staff will also review applications for businesses that EITHER didn’t receive federal assistance OR were affected by state orders

As 6/10/2020, the WBC has received 2,083 applications and has approved $1.33 million for payment.

***

ORIGINAL INFORMATION:

The Wyoming Legislature crafted three grant programs during a special session May 15-16 to distribute $325 million in federal CARES Act funding for Wyoming small-business owners who have experienced hardship related to COVID-19. Governor Mark Gordon signed the bill on May 20.

The Wyoming Business Council is working to stand up the three relief programs as quickly as possible while ensuring the application process is secure, accessible and easy to use.

Click here to learn more about these programs, how to apply, and about events to help Wyoming entrepreneurs participate.

Contact your local Wyoming SBDC Network advisor for no-cost, confidential assistance with these programs. Get in touch with your local advisor by clicking here, or submitting your email and county in the forms at the top or bottom of this page.

Economic Injury Disaster Loans - Closed

***UPDATES***

1/4/21

EIDL applications have been expanded through December of 2021.

8/25/20

The SBA has released a list of Frequently Asked Questions with answers to cover your questions about EIDL. Find this helpful resource here https://sba.app.box.com/s/q4d09lgo4p2aytl6f7ownp6ubx2a5y3s

7/22/20

SBA has become aware of certain suspicious activity associated with the COVID-19 EIDL loan program. SBA is requesting the assistance of depository financial institutions in identifying and reporting suspicious activity to SBA as well as to other appropriate regulatory agencies. Examples of COVID-19 EIDL suspicious activity include, but are not limited to, the following:

-Use of stolen identities or EIN or SSN numbers to qualify for the EIDL advance or EIDL loan.

Purported businesses, including front or shell companies, lacking indicia of operating presence or history, receiving EIDL advances or EIDL loans.

-Applicants working with third parties to obtain EIDL advances or EIDL loans in exchange for keeping a percentage of the funds.

-Account holders that are victims of social engineering schemes and may not know that the source of the funds is an EIDL advance or EIDL loan.

-A customer advises a financial institution that the customer received a COVID-19 EIDL ACH deposit from “SBAD TREAS 310” and “Origin No. 10103615” into their account, but did not apply for a COVID-19 EIDL loan.

-A customer receives a COVID-19 EIDL ACH deposit after the financial institution previously denied the customer’s Paycheck Protection Program (PPP) loan application, particularly where the financial institution identified inaccurate or incomplete information in the customer’s PPP loan application.

Additionally, depository financial institutions are encouraged to examine the following transactions more closely to determine if they constitute COVID-19 EIDL suspicious activity:

-A customer not known to be a small business, sole proprietor, or independent contractor receives a lump sum COVID-19 EIDL ACH deposit from “SBAD TREAS 310” and “Origin No. 10103615” into a personal account.

-A new customer opens an account and shortly thereafter receives a COVID-19 EIDL ACH lump sum deposit from “SBAD TREAS 310” and “Origin No. 10103615”.

-A single account receives multiple EIDL advance or multiple EIDL loan deposits.

6/16/2020

To further meet the needs of U.S. small businesses and non-profits, the U.S. Small Business Administration has reopened the Economic Injury Disaster Loan (EIDL) and EIDL Advance program portal to all eligible applicants experiencing economic impacts due to COVID-19.

SBA’s EIDL program offers long-term, low interest assistance for a small business or non-profit. These loans can provide vital economic support to help alleviate temporary loss of revenue. EIDL assistance can be used to cover payroll and inventory, pay debt or fund other expenses. Additionally, the EIDL Advance will provide up to $10,000 ($1,000 per employee) of emergency economic relief to businesses that are currently experiencing temporary difficulties, and these emergency grants do not have to be repaid.

SBA’s COVID-19 Economic Injury Disaster Loan (EIDL) and EIDL Advance

- The SBA is offering low interest federal disaster loans for working capital to small businesses and non-profit organizations that are suffering substantial economic injury as a result of COVID-19 in all U.S. states, Washington D.C., and territories.

- These loans may be used to pay debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact, and that are not already covered by a Paycheck Protection Program loan. The interest rate is 3.75% for small businesses. The interest rate for non-profits is 2.75%.

- To keep payments affordable for small businesses, SBA offers loans with long repayment terms, up to a maximum of 30 years. Plus, the first payment is deferred for one year.

- In addition, small businesses and non-profits may request, as part of their loan application, an EIDL Advance of up to $10,000. The EIDL Advance is designed to provide emergency economic relief to businesses that are currently experiencing a temporary loss of revenue. This advance will not have to be repaid, and small businesses may receive an advance even if they are not approved for a loan.

- SBA’s EIDL and EIDL Advance are just one piece of the expanded focus of the federal government’s coordinated response.

- The SBA is also assisting small businesses and non-profits with access to the federal forgivable loan program, the Paycheck Protection Program, which is currently accepting applications until June 30, 2020.

For additional information, please visit the SBA disaster assistance website at SBA.gov/Disaster.

5/5/2020

If you have previously submitted an application and have an application number that begins with a “2”, you must reapply immediately to make sure your application is processed. This applies to ALL businesses, not just agricultural businesses.

5/4/2020

Currently, the Economic Injury Disaster Loan program is accepting new applications from agriculture businesses only. Please click here to learn more.

For non-agriculture businesses: Due to limited appropriations funding, the U.S. Small Business Administration is currently not accepting applications from non-agriculture businesses for the Economic Injury Disaster Loan (EIDL) program.

If you have started an EILD application or are gathering your documents, please continue to do so. If more money is appropriated, then you will want to be prepared with your applications. Applicants who have already submitted their applications will continue to be processed on a first-come, first-served basis.

***

ORIGINAL INFORMATION:

The U.S. Small Business Administration is offering designated states and territories low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of the Coronavirus (COVID-19).

Small businesses may also apply for an Economic Injury Disaster Loan advance of up to $10,000. This advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available within three days of a successful application. This loan advance will not have to be repaid.

Contact your local Wyoming SBDC Network advisor for no-cost, confidential assistance with Economic Injury Disaster Loans. Get in touch with your local advisor by clicking here, or submitting your email and county in the forms at the top or bottom of this page.

You can read more from the SBA or apply for the EIDL loan or the emergency advance by clicking here.

SBA Loan Debt Relief - Closed

Updates

12/27/20

“Small business is big business in America, and this Administration will continue to extend a lifeline to small business owners during this critical time. Congress charged the SBA with making debt relief payments (principal, interest and fee payments) under Section 1112 of the CARES Act to help borrowers in SBA’s 7(a), 504 and Microloan programs; and now SBA is working expeditiously to implement the newly enacted assistance.

“The new law extends SBA debt relief authority, allowing the Administration to continue alleviating adverse economic effects of COVID-19 for small businesses with SBA loans. Since April last year, the SBA has made over $7.1 billion in payments across 1,819,130 loans on behalf of these borrowers. It’s important to note that these firms were also initially able to access capital because of the SBA federal guarantee.”

The SBA is determining how much additional debt relief assistance can be provided to SBA borrowers with the newly issued Congressional appropriation. Debt Relief guidance will soon be posted on the SBA website.

—

As part of SBA’s debt relief efforts,

- The SBA will automatically pay the principal, interest, and fees of current 7(a), 504, and microloans for a period of six months.

- The SBA will also automatically pay the principal, interest, and fees of new 7(a), 504, and microloans issued prior to September 27, 2020.

If you have other loans not mentioned above, talk to your banker as soon as possible to plan short-term financing options. Inquire about the SBA Federal Disaster Loans, interest-only payments, payment deferment, and refinancing to add working capital.

Key Aspects:

- For current SBA Serviced Disaster (Home and Business) Loans: If your disaster loan was in “regular servicing” status on March 1, 2020, the SBA is providing automatic deferments through December 31, 2020.

- What does an “automatic deferral” mean to borrowers?

- Interest will continue to accrue on the loan.

- 1201 monthly payment notices will continue to be mailed out which will reflect the loan is deferred and no payment is due.

- The deferment will NOT cancel any established Preauthorized Debit (PAD) or recurring payments on your loan. Borrowers that have established a PAD through Pay.Gov or an Online Bill Pay Service are responsible for canceling these recurring payments. Borrowers that had SBA establish a PAD through Pay.gov will have to contact their SBA servicing office to cancel the PAD.

- Borrowers preferring to continue making regular payments during the deferment period may continue remitting payments during the deferment period. SBA will apply those payments normally as if there was no deferment.

- After this automatic deferment period, borrowers will be required to resume making regular principal and interest payments. Borrowers that canceled recurring payments will need to reestablish the recurring payment.

- Review this comparison guide between the various relief efforts from the SBA.

If you have any questions, contact your local Wyoming SBDC Network advisor for no-cost, confidential assistance. Get in touch with your local advisor by clicking here, or submitting your email and county in the forms at the top or bottom of this page.

You can read more from the SBA by clicking here.

Protect Your Business From COVID-19

General COVID-19 Tips for Your Business

Your local Wyoming SBDC Network advisor is constantly training to stay up-to-date on all the resources and information related to the coronavirus pandemic. Get in touch with you local advisor for no-cost, confidential assistance regarding any of the topics on this page.

Tips:

- Beware of scams. As aid programs for entrepreneurs are increasing, so are the amount of scammers trying to take advantage of small businesses. Also, as more and more people are working from home, it is important to make sure your website and internal networks are secure. The Wyoming SBDC Network’s cybersecurity expert can help you protect your business.

- Learn how to report scam attempts.

Other Links:

- COVID-19 Response Tips from the Wyoming Business Council

- Wyoming Department of Workforce Services COVID-19 Resources

- Guidance from the CDC

- Tips for Small Business from the CDC

- SBA Coronavirus page

Get in touch with your local Wyoming SBDC Network advisor by clicking here, or submitting your email and county in the forms at the top or bottom of this page.

State Health Orders

The office of Governor Mark Gordon has issued the following official health orders related to COVID-19 resources for small businesses

There are currently no statewide health orders in effect. Consult with your county or city to determine your local regulations.

Click here for the latest case numbers from the Wyoming Department of Health.

State Case Data

Last Updated 9/28/22 9:00am MDT

These statistics are updated every Tuesday

COVID-19 (novel coronavirus) continues to have a big impact on small businesses in our state. However, there are plenty of available COVID-19 resources for small businesses in Wyoming.

Latest COVID-19 Statistics in Wyoming:

- Deaths: 1,894

- Confirmed Cases: 138,194

- Probable Cases: 38,534

Click here for the latest Wyoming Public Health Orders.